Mark and Kev also discuss investing abroad, the best way to do crypto and the biggest financial mistakes they see people making again and again.

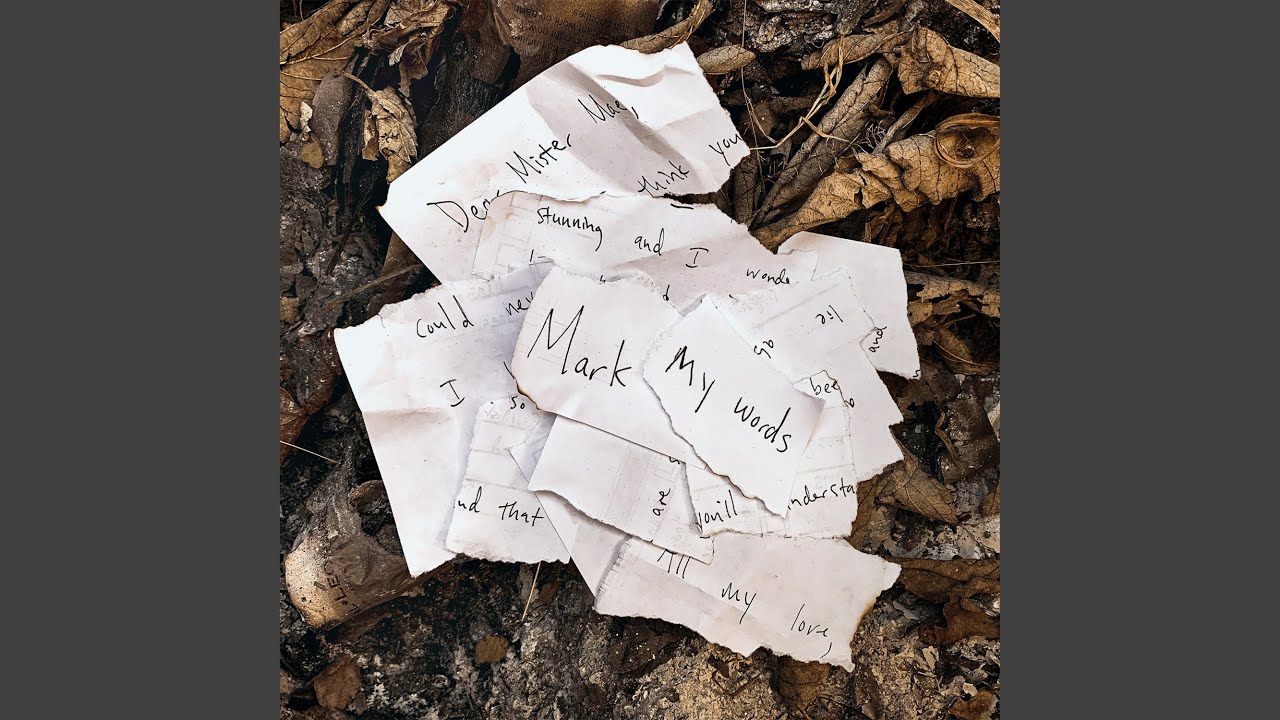

#Markmywords how to

CONTACT METHOD Email: LinkedIn: Facebook: Twitter: ‘Brought to you by Progressive Media’: See /listener for privacy information.ĬLASH OF THE TITANS - Go To to find out more FREE DOWNLOAD How YOU Can Make A FORTUNE From Buy-To-Let Join Mark as he speaks to Kevin for a second time about how to build and manage a property business including your accounts and finances as well as investing. He is a systems and spreadsheet geek and has developed a complex, confidential deal analyser system of buying residential, commercial and multi-let properties.

BEST MOMENTS “I think quite a few landlords are selling because of this, this could be an opportunity” “More and more of these sources of energy are coming online now” “I don’t think the energy cap will be needed in the same way going into 2024” VALUABLE RESOURCES ABOUT THE HOST Mark has bought, sold or has managed around 1,000 property units for himself, Rob, his family and his investors since 2003. This means that electric car demand has also dropped, they aren’t as financially attractive as they were.

Diesel and petrol prices have dropped significantly, almost hitting pre-2020 levels. Fuel prices will start to fall this year as wholesale priced drop and alternative options become available. Some landlords will be selling due to this which presents investment opportunities for those who are willing to put the work and knowledge in. There are exemptions, particularly if it’s going to be very costly for you to improve. Start planning for your properties now, as the deadline gets closer EPC experts will become busier and it will be more costly for you to make the necessary changes. The best ways to go from a D or an E to a C rating is by a few small changes, such as energy saving lightbulbs, adding a storage heater or adding solar panels. KEY TAKEAWAYS The government has confirmed that landlords will need to meet an EPC rating of C or better by 2028 for new and existing tenancies.

#Markmywords update

In this episode, Mark gives an update on energy, particularly on how this will impact landlords and the property market. CONTACT METHOD Email: LinkedIn: Facebook: Twitter: ‘Brought to you by Progressive Media’: See /listener for privacy information. He is a system and spreadsheet geek and has developed a complex, confidential deal analyser system of buying residential, commercial and multi-let properties. BEST MOMENTS ‘There are less landlords coming into the market and that’s pushing rents higher and higher’ ‘Prices have fallen and there are still some deals out there’ ‘The IMF says the natural point of interest in the UK is way lower than we are at the moment” VALUABLE RESOURCES ABOUT THE HOST Mark has bought, sold or has managed around 1,000 property units for himself, Rob, his family and his investors since 2003. Mark suspects interest rates will drop in the next few years. The government haven’t helped tenants, landlords are selling up meaning less supply and so prices have increased. KEY TAKEAWAYS Being debt free isn’t always the best option, it can be worth investing money into property rather than paying off your mortgage Inflation will be paying your debt down, including your mortgage debt.

Mark answers some of the most asked questions he is getting at the moment including why yes now is a good time to invest in buy to lets, why interest rates will be dropping and why some debt can be good.

0 kommentar(er)

0 kommentar(er)